FCM Consulting has released its latest “Global Quarterly Trend Report,” which provides an insightful look at forecasts for the year ahead and the key trends shaping the business travel industry. The report is sourced using FCM’s corporate booking data from the fourth quarter of this past year, between October to December 2023.

According to the report, the end of 2023 closed a milestone year for the industry, resulting in the busiest and least interrupted year for business travel in over four years. And with traveler confidence on the rise, the data suggests there will be even more trips booked in the year ahead, despite rising costs across the airline, hotel, and car rental market.

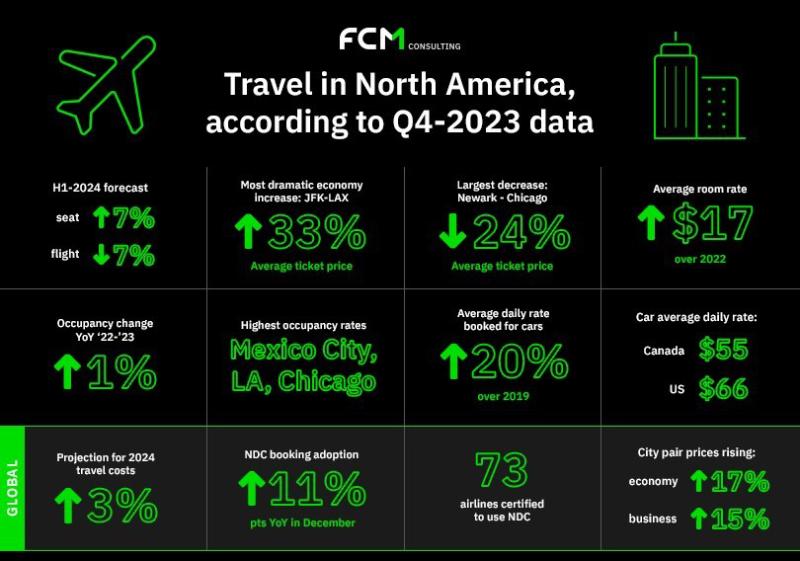

The report highlighted a key trend that is set to continue for 2024—more seats with fewer flights—as global air travel capacity is expected to surpass annual capacity levels from 2018 and 2019. As a result of fleet configuration changes and shifts in schedules to meet demand, the global forecast for the first half of 2024 is that there will be 97.9 million (+3.5 percent) more seats and 2.1 million (-5.6 percent) fewer flights offered, compared to the same period in 2019. Regionally, the forecast for North America predicts that there will be 7 percent more seats and 7 percent fewer flights offered.

Despite the increased seat capacity, businesses will still have to potentially reset their budgets as travel costs are projected to increase across the industry by approximately 3 percent. Based on a price analysis of 380 different city pairs across the world, global economy airfares were up $76 (+17 percent) and business airfares were up $246 (+15 percent) in 2023, compared to 2019. In North America, the city pair with the largest economy rate increase (33 percent) was New York (JFK) to Los Angeles, while Newark to Chicago (ORD) saw the largest rate decrease (24 percent). The city pair with the only business rate increase (11 percent) was JFK to Calgary.

On the accommodation side, the average room rates (ARR) in North America increased to $250 (+$17) in 2023 versus 2022. Compared to the previous quarter, some of the largest rate increases in during Q4 2023 included Mexico City (+37 percent), Los Angeles (+36 percent) and Chicago (+12 percent), while Vancouver (-32 percent) and New York (-22 percent) saw some of the largest rate decreases. Overall, Q4 2023 saw just a 1 percent increase from Q3 2023 though, signaling a potential return to rate stability. Furthermore, occupancy levels, which were at 63 percent in 2023, also seem to have stabilized in North America as there was just 1 percent growth year-over-year.

The report also analyzed the car rental market and the global average daily rate (ADR) increased to $73 (+$20) in 2023 versus 2019. However, in comparison to the global level, the ADR for the U.S. ($66) and Canada ($55) were each lower for the full year.

Source: FCM Consulting

Related Stories

Q4 2023 Group Business Up Across Key Metrics: Stats

AI-Focused Research Highlights Need to Upskill Employees

Cost of Living Crisis: Organizers Hike Salaries, Consultant Fees

Study Shows Importance of Business Travel in Hybrid Working Era